Armed forces Admiration Week: Closing Va Financing Whenever Implemented

What You will learn

Immediately following a long homebuying travel, you’ll find nothing like an impact away from closing on your own home. But what goes if you’re a working-obligation services member? Absolutely who would complicate the latest closure procedure, best?

You believe one to being stationed someplace else tend to harm your chances out-of actually closing in your Va loan with time (otherwise at all, even), however, the audience is right here to inform you that’s not the outcome! It Military Appreciate Month, we have the interior information on how you can close your Virtual assistant financing while you’re however implemented.

Occupancy Standards

Since you may be aware chances are, Virtual assistant money can only just financing primary houses, meaning consumers are expected to reside in Related Site our home immediately after their mortgage shuts. This new You.S. Agencies out of Veterans Situations doesn’t allow the use of Virtual assistant fund to have funding or trips properties. Yet not, licensed buyers is also own a couple of number one homes once they take for every for around six months inside a-year.

Fundamentally, Virtual assistant mortgage borrowers has actually around two months prior closing so you’re able to transfer to and you may consume their new household. The new Virtual assistant makes reference to this era since reasonable time to repay off on your this new put blog post-closing. In case you will be implemented, two months might not be plenty of time to help make your disperse back home.

Virtual assistant fund manage allow it to be, significantly less than specific situations, due to their borrowers to extend its full-date occupancy time up to a-year immediately after closing. To make the newest offered occupancy day, you ought to move into the new home in less than 12 days, and you also need to tell your lender precisely why you try not to inhabit their home during the time.

Needless to say, partners from implemented services participants may also play the role of the new home’s official tenant in order to meet brand new 60-day criteria. Likewise, your spouse, or any other individual of your preference, can also be sign one other finally closing files on your behalf whenever you are you’re abroad, however financing try only on your own title, you must very first have a limited power away from lawyer (POA) into the document.

Getting an energy off Attorney

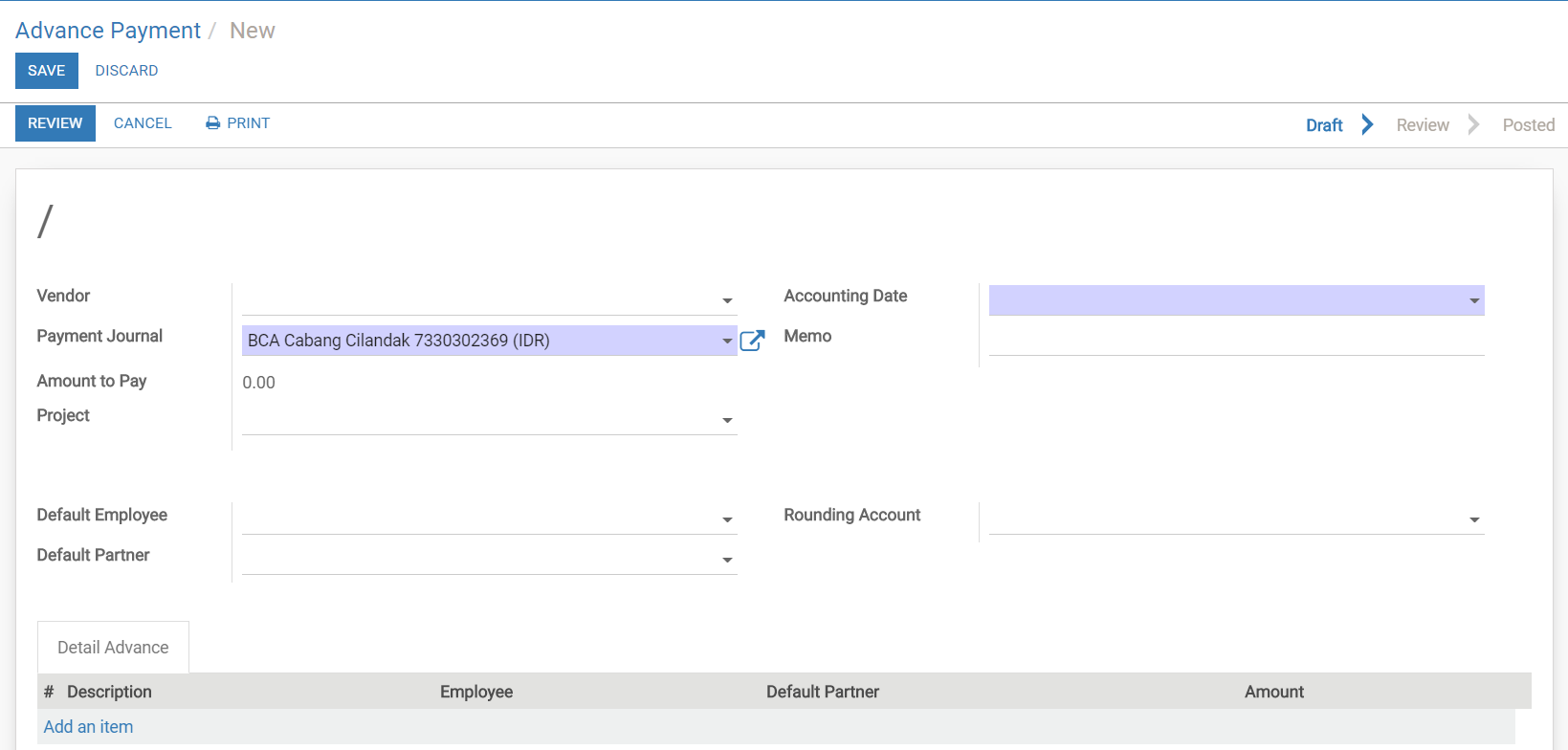

A limited POA is actually a permission which allows another type of team so you can do the litigation required for you to definitely done the loan (limited meaning just the mortgage, perhaps not medical and other behavior) while you are away.

Their POA would be to approve a certain individual, because if that you don’t, the latest builder, lender, otherwise name providers may not accept your favorite individuals trademark as an alternative of yours. You may want to be required to use a certain POA setting. The latest POA should be approved by their bank, and in most cases, it ought to be finalized in the visibility out-of an effective notary.

If not should indication a POA, you could still pick a house when you are deployed for folks who normally sign data electronically and in people that have an effective notary for the the space where you stand deployed. You may find a notary on your own military base or from the this new U.S. Consulate when you find yourself during the a foreign country.

You might Still Incorporate, As well!

And for the individuals implemented whom have not removed good Va financing but really, however they are finding doing this, it’s not too late! This new Virtual assistant financing was a home loan system open to active and you can resigned army, reservists, and you will thriving partners. This type of finance supply to 100% resource which have flexible being qualified conditions and you can good loan words.

No monthly home loan insurance rates and re also is made for individuals otherwise spouses who are eventually happy to settle down just after finishing the services. Reach out to an Atlantic Bay Financial Banker right now to discover if you meet the requirements, and further learning towards the Virtual assistant money, talk about other stuff regarding Education Cardio!