At the same time, the fresh Everything in one Loan work identical to a standard examining account

Because the a home loan provider youre likely on the lookout for new loan situations to assist identify your company while serving the requirements of your web visitors. Better take a look at the latest All-in-one Loan away from CMG Financial, offered because of our very own General Lending Conversion process Department when you look at the get a hold of avenues all over the world.

- Loan wide variety as much as $2 million (geographic restrictions could possibly get apply)

- 30 seasons identity family collateral personal line of credit having 31 year mark accessibility

- Stuck sweep-savings account that have 24/7 banking use of personal line of credit and you will financing

- Atm debit POS notes, limitless check writing an internet-based expenses-pay and statement are included

- 10% deposit significance of orders

- Get and you will refinance deals welcome

- Primary, 2nd Property, and you will Low-Proprietor filled residential property

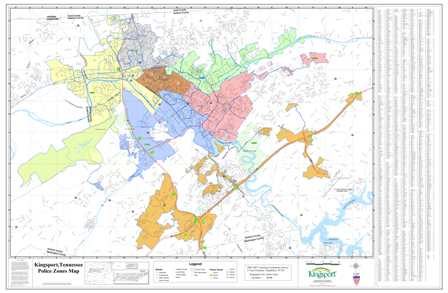

- Unit access may be geographically limited

Initiating The newest Everything in one Financing

What makes the brand new All in one Financing very strong is that it’s just not a standard closed-ended financial, but instead, a house guarantee credit line. Lines of credit is actually novel because they are flexible, two-method products enabling the customer to make use of normally money due to the fact they demand with the the balance in the place of losing accessibility their money. The fresh Everything in one brings 30-seasons use of home security bucks, has an effective low rate, no invisible charge otherwise required balloon payment.

So it revolutionary structure allows your prospects to utilize the informal dollars flow so you’re able to offset the loan’s balance and you will help save financial appeal versus demanding a switch to its finances.

Deposits made into the fresh Everything in one Mortgage pay down dominating first and remain readily available 24/eight from banking has. The borrowed funds boasts Automatic teller machine cards for everyone pages of the membership, secured online statement-shell out, unlimited check writing, head put and you can financial-to-lender wire transferring. Their customer’s monthly attention money is computed on every day’s conclude harmony, therefore even while it withdrawal money from their account for normal expenses, its loan’s daily harmony was remaining down for longer – and therefore equates toward smaller desire becoming billed than simply that have a old-fashioned home loan.

Ultimately, your client stops paying far more attract on the financing through its normal earnings than what they may generally earn for the people cash within the a typical bank account. Less of their money used on month-to-month financial attract mode a whole lot more of its currency left to assist them to satisfy other monetary objectives.

Your Industry

Consider what your business could have been through over the course of the past several years. From property growth in order to housing boobs and you will widespread monetary suspicion – training have been discovered. In reality, a conversion that taken place because the start of the brand new 2008 financial crisis is where People in america perceive obligations – especially property owners – as well as the issues their financial poses on their full monetary health.

Even after authorities intervention and list low interest, scores of home owners nonetheless are obligated to pay trillions from dollars to their property and not be able to get the fresh new money they need in their features and you will rescue having old-age.

Nevertheless don’t should be that way as a consequence of the newest All-in-one Loan. Into All-in-one Financing, you might let consumers avoid tens and thousands of bucks inside the extreme mortgage attention, pay-out-of by 50 percent committed otherwise quicker, and get access to the home’s equity cash without the need to refinance.

Starting

New All-in-one Mortgage has proven to produce new clients getting not merely loan originators however, advice offer installment loans Texas as well. On the other hand, it will help you are still active and you may winning during negative rate surroundings because it’s quicker based upon than just traditional mortgage loans on attract rates provide savings.

Do your organization a favor and contact a good CMG Financial Section Transformation Director to start your education on this leading edge loan product now.