Help guide to Mortgage Advertising Conformity to your Social media

State and federal recommendations

Regarding mortgage adverts, government advertising regulations affect consumer mortgages while you are condition legislation apply to help you each other consumer and organization mortgages. While you are federal rules affect all mortgage lenders, just be sure to consult this new regulations of your state in order to be certain that compliance. Right here i look at a number of the government statutes governed because of the the latest Government Trading Fee (FTC) and the User Financial Protection Agency (CFPB).

First-point-of-contact info regulations

First-point-of-get in touch with identifies sales product designed to make very first experience of a possibility so you’re able to introduce a love. These types of income may include anything from team cards and stationery in order to letters, other sites, and social networking pages. Any earliest-point-of-get in touch with material you create must include the broker’s name and also the licensing quantity of per representative.

Method of getting said mortgages

If you market particular home https://paydayloanalabama.com/reeltown/ loan words, these terms and conditions have to in fact be accessible in order to a debtor. The newest misrepresentation of a consumer’s likelihood of financial recognition violates Regulation Letter, hence we shall describe for the-breadth lower than.

Misleading conditions

Any form away from ads, plus social network, ought not to become any incorrect otherwise mistaken words that misguide this new borrower. This can include interest rates, charge, costs, taxation, insurance coverage, and you may any potential areas of a stated mortgage.

Leading to terminology

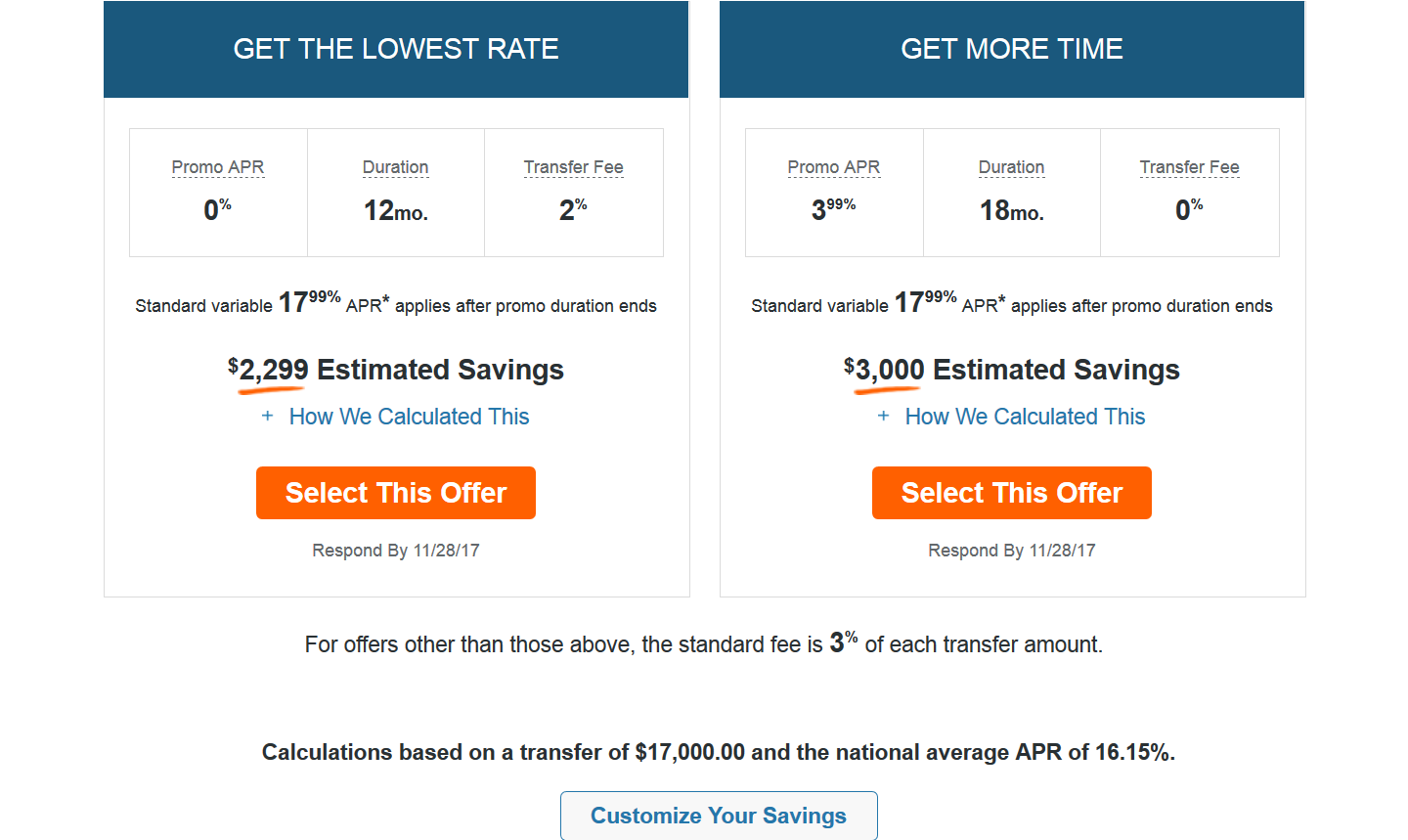

The FTC defines one terms and conditions or sentences one advertise certain words off a credit contract given that leading to words. When this type of words are utilized into the social media marketing, disclosures are needed. Leading to terminology range from the amount of a funds costs, what number of payments, and you will a deposit amount conveyed since the a portion or a whole dollars count. Advice could well be For only 3.5% down otherwise 30-12 months home loan.

Almost every other restrictions

Also aforementioned guidelines, mortgage advertisements is additionally banned off advertising including new simulation out of a check, as they possibly can misguide borrowers towards the considering he is guaranteed money that’s not indeed accessible to them. At the same time, zero version of mortgage business is also discriminate according to origins, colour, disability, marital reputation, pure provider, race, faith, otherwise sex.

Mortgage advertisements on the Fb

Many social media networks, like Myspace, are created to let entrepreneurs continue to be agreeable making use of their governments in terms of selecting address watchers. Particularly, when designing Fb paigns, Myspace necessitates the accessibility Special Offer Visitors needless to say advertisers to decide a broad projected audience that’s named way more comprehensive and you can low-discriminatory.

Guidelines regarding interest rates

Most recent rates of interest can be used inside the home loan adverts that have criteria. First off, people interest you encourage must be the genuine rate you to your business is already offering. Because of this if for example the offering speed alter, you will want to quickly alter your advertisement to help you mirror the brand new rate or remove the advertisement totally. On the other hand, you ought to display screen new apr, or Apr, conspicuously.

Handling home loan conformity

With regards to financial ads, you will find several particular regulations one mortgage brokers must pursue when you look at the order to remain agreeable. The 3 fundamental guidelines when it comes to ads is laws B, Letter, and you may Z.

1. Controls B

Regulation B is the Equal Credit Opportunity Operate (ECOA) in fact it is designed to ensure that every creditworthy people can get to mortgages. Although this regulation doesn’t promote particular advertising criteria, it does ban loan providers away from practices, and advertising, that discriminate against customers according to decades, ethnicity, gender, relationship status, and you may nationality.

dos. Controls N

Control N are established of the User Economic Defense Agency (CFPB) and the FTC in the Home loan Acts and you can Methods from inside the Advertisements rules. It control has all first advertisements legislation getting commercial sale product. The objective of it control should be to exclude misleading home loan advertisements, plus things like financial method of misrepresentation, not offering the variability of great interest pricing, not appearing possible client costs, rather than describing how a predetermined-price home loan can transform along the long lasting.

step 3. Controls Z

Controls Z ‘s the Basic facts into the Credit Law. The purpose of this controls will be to offer customers towards actual cost of the loan and you will allows finest borrowing identity and speed contrasting between lenders. That it controls requires that all real estate loan ads contains the information so you can customers and won’t is things mistaken. It requires the newest disclosure of great interest cost, both moderate and you may Annual percentage rate.

Ensuring Myspace deals is agreeable

For the rise in popularity of social networking, social media is important to own providers success additionally the age bracket of the latest prospects. Although not, because the the home loan company was at the mercy of audits, it is essential to make certain that all of your revenue perform, in addition to social networking, proceed with the rules and stay agreeable in order to avoid fees and penalties or, in the a worst-case situation, a lockdown.

From the An excellent Temper Group, we understand how important lead generation is to try to a profitable organization. The Unfair Advantage program can help you improve your prospecting and you may bottom line. Schedule a technique label around right now to find out more about just how our team will give your business the fresh new improve it entails.