Just how long Do A mortgage Preapproval History?

Whenever you are searching for a unique house, it is recommended you earn home financing preapproval first off the home to buy process. Whenever you are a mortgage preapproval isnt a good 100% protected mortgage, it will give you a concept of what type of financing conditions you can expect as well as how much home you can afford. When you get preapproved to own home financing, their lender tend to check your income and financial guidance to allow you understand how much domestic you really can afford.

What is actually Home loan Preapproval?

A home loan preapproval is a conditional acceptance you to tells you what type of financing words can be expected after you buy a good family. Within the preapproval techniques, the lending company commonly look at your earnings, credit history and debt-to-money (DTI) proportion. The credit make sure that their lender really does possess a little affect your credit rating, even if for individuals who get preapprovals with several lenders inside the exact same time, these borrowing monitors can be mutual and considered one to pull on your credit history.

The fresh new preapproval procedure can help you know if you might be qualified getting a home loan and you will, therefore, what kind of rate of interest and you can terms we offer. Included in the techniques, the bank will normally give you good preapproval letter – a document claiming the absolute most you could use, their estimated monthly payments along with your interest. When you generate a deal on the a house, you can inform you the seller their preapproval letter. This lets them know you may be a serious house customer and could let your odds of which have a deal approved.

Mortgage Prequalification Compared to. Preapproval

There was a big difference ranging from preapproval and you will prequalification, whilst the one or two conditions voice similar. While in the an excellent prequalification, the financial institution will generally leave you a sense of the rates and you can words, based on economic information that you give. Just like the financial can perform restricted confirmation of the wide variety, one prequalification should be considered only original.

Additionally, the financial institution does an even more thorough post on debt problem inside the preapproval processes. Whilst means a lot more due diligence, its much more legitimate than simply a great prequalification. Whenever you are serious about to acquire a property, you ought to do the expected actions to obtain a beneficial home loan preapproval letter.

Just how long Really does A Preapproval Having Home financing Past?

After you’ve started preapproved, the financial preapproval page generally can last anywhere between 60 ninety days, depending on the lender. There are numerous grounds that the bank often put a keen termination go out on your preapproval letter. Primarily, it is because the home loan preapproval is dependant on your existing monetary problem. Should your financial predicament transform (such as for example should you get another job and take out good the mortgage), your financial may wish to remark the job once again.

Could you Offer A home loan Preapproval?

When you find yourself home loan preapprovals perform expire, it can be you’ll be able to to extend a great preapproval. This is exactly called for if you find yourself having trouble trying to find a house that you want to invest in. An effective preapproval extension may need a supplementary difficult pull-on their credit, which will maybe effect your credit score. The records the financial must offer the preapproval will vary however, will generally become exactly like those necessary for the initially preapproval.

When to Score Preapproved Having A home loan

A good preapproval will be generally come very early yourself purchasing techniques. It’s important due to the fact visitors to understand what sorts of financial you may possibly qualify for. It will help guide your home to acquire process and relieve the fresh likelihood of issue while in the underwriting and you can closure.

That have a proven Approval Letter 1 from our nearest and dearest on Skyrocket Mortgage early in the process may also help make your get even offers alot more appealing to prospective sellers. With the knowledge that you will be affirmed and you can preapproved assists providers be positive that you’re a purchaser exactly who wouldn’t spend the some time was able to effortlessly personal.

How to get Preapproved To own Home financing

- Look at the credit report: It’s a good idea to find out where you stand borrowing from the bank-smart before you apply to own preapproval. You can travel to AnnualCreditReport to help you request a totally free duplicate of one’s statement from the around three biggest credit bureaus. This will assist you to make fully sure your credit history try upwards thus far which there aren’t any problems. You are able to display their borrowing from the bank consistently with Skyrocket Money SM .

- Collect the necessary records: New preapproval processes will go quicker for individuals who very first take time to collect most of the papers their lender will need. The documents expected are different of the bank, however, will include paystubs otherwise proof money, W-dos comments, financial comments and you may taxation recommendations.

- Wait until you may be ready: Due to the fact preapproval characters end after a certain amount of date, you need to hold off to apply if you do not is actually surely provided trying to find and you can and come up with a deal on property.

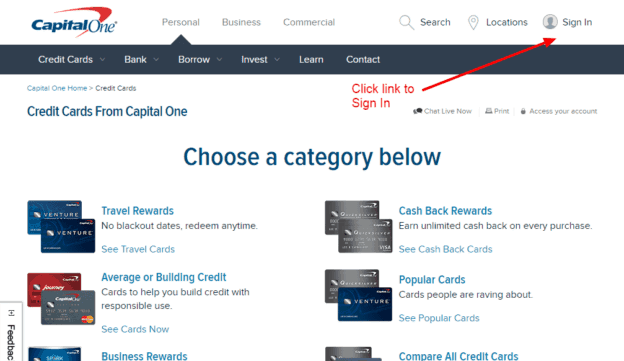

- Use along with your bank: The past action is by using having home loan preapproval in person which have your own bank.

The bottom line

Delivering preapproved in early amount of the property to find processes is usually the initial methods you can make. Delivering preapproved out-of a professional financial can help you discover if or not you can easily become acknowledged to possess a home loan, and how a lot of a mortgage you qualify for. This can help direct you because you start our home to order process. That have a beneficial preapproval letter may also help as you create pick also provides – it allows providers remember that your give is actually a serious you to definitely that is very likely to close.

step one Contribution regarding the Verified Recognition system is dependent on an enthusiastic underwriter’s comprehensive studies of the credit, earnings, work updates, property and you can loans. In the event the the latest advice materially changes the brand new underwriting decision resulting in a assertion of borrowing demand, if for example the loan fails to intimate to own an explanation beyond Skyrocket Mortgage’s manage, as well as, although not restricted to sufficient insurance rates, appraisal and you can name declaration/lookup, or you no further want to follow the loan, your own participation on system might be deserted. Should your qualifications regarding the system cannot alter as well as your mortgage loan cannot personal on account of a rocket Home loan error, you will have the $step one,000. It promote will not affect the fresh new get instant same day payday loans online Tennessee fund published to Rocket Financial thanks to a large financial company. Rocket Home loan reserves the ability to terminate which provide any kind of time date. Anticipate in the provide constitutes this new desired of those terminology and you can conditions, being susceptible to change from the just discretion out-of Skyrocket Mortgage. Additional conditions or conditions could possibly get use.