Many number representatives and you can vendors simply do not know Va Funds

Colorado’s market try intense! We have never seen a market therefore greatly-weighted for the an excellent seller’s prefer compared to earlier three years. I’ll walk you through the newest anatomy away from just what we have been watching when you look at the the present day – next I shall show my personal applying for grants as to the reasons Veterans stay at an excellent aggressive downside.

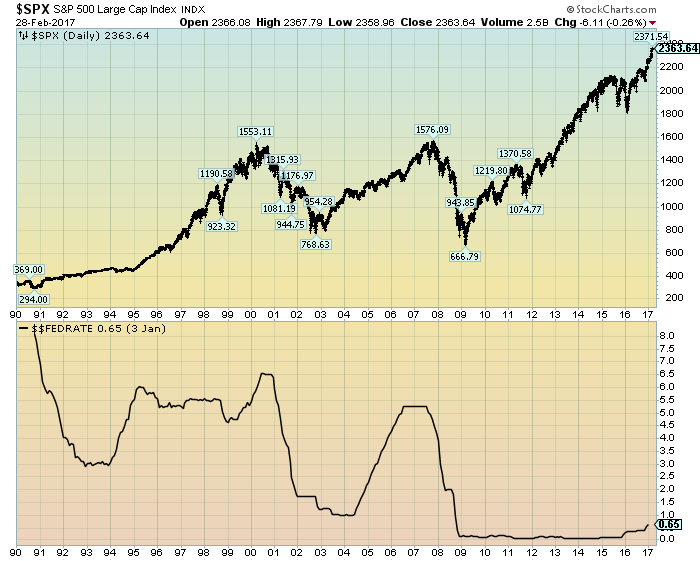

Understanding t the guy Latest Denver Real estate , inventory and you will days with the sector are expanding (get a hold of most recent sector style report) when you’re home loan rates stay in the fresh higher 6-7% diversity. Of many property in the market aren’t valued precisely, so in some cases you will find space so you can negotiate a fair rates. The fresh gold lining these days is Va loans have been in a robust updates getting noticed as a result of the shortage of competition very sellers exactly who just after don’t you should consider a beneficial Virtual assistant consumer (Va Mortgage) due to daunting race, are now thankful to help you. Just like towards the battlefield, I’m always creating intel for the marketplace and you will know precisely what to come across of course, if so you can strike giving my personal Va consumers a strategic advantage. When you’re interest levels remain experienced higher versus history , just be capable re-finance for the a reduced 31-year fixed home loan.

How is actually Pros within a competitive drawback? This is certainly a beneficial touchy subject personally because causes my blood cook to see just how Virtual assistant visitors also provides are not drawn definitely. Obtained unfairly be stigmatized in the current ongst anything else) of several accept that a beneficial $0 Money Down payment financing in some way means that the fresh Seasoned possibly doesn’t have an advance payment otherwise enough money to shut. None of them is secure to imagine. I have been working with Experts and you can Va funds to possess sixteen years and possess never ever (ever) had an effective pre-accepted Va financing you to did not romantic – but really bucks and you will traditional selling fall because of all the time. Simply because a veterinarian decides not to set hardly any money off does not mean the guy/she doesn’t have they, a bit honestly occasionally, it is on the contrary. Let’s say you’d $10k/$20k/$30k or $100k to get upon a house, nevertheless the mortgage you qualify for has no need for a down-payment – are you willing to? Zero freakin’ means! Not just manage Virtual assistant finance not need an advance payment, nonetheless they don’t need pricey month-to-month financial insurance while the attention rates is often only a little less than something regarding the areas. Once more, might you pass that upwards in the event the because of the possibility? No freakin’ way!

Therefore, toward a highly basic, if you were attempting to sell a good $400,000 house and had a small number of also provides and if $10,000 more than record rate and you can nothing with revenue contingencies: Buyer#1 $80,000 off; Buyer#2 $100,000 off; Buyer#step 3 $two hundred,000 off; Buyer#4 Bucks; Buyer#5 $0 down. I haven’t actually started to discuss inspections otherwise appraisals yet ,, you envision a merchant was bending in one single advice currently? Maybe. perhaps not. Specific vendors have said understanding on rigorous Virtual assistant inspections, appraisal and you will work deadlines – every contributing to headaches they’d as an alternative maybe not manage. Fair enough. if this wasn’t incorrect. In my opinion, monitors that will be blatant wellness/questions of safety could well be entitled out, but they really and truly just have to ensure the lay are habitable that have functioning appliances, running water and you will a functional furnace. Would be the fact really too much to ask?

Swinging onto appraisals and work deadlines. It is definitely correct that Virtual assistant appraisals don’t have any due dates. Whoa. whoa. whoa. Zero due date setting a supplier is at brand new compassion out of a beneficial due date that has not any big date regarding conclusion. Yeah, so what! If you ask me, Virtual assistant appraisals get complete earlier than antique appraisals anyhow (my personal history Virtual assistant assessment is actually completed in seven business days). Of many fear one to Va appraisers will come in lower. Once more, I’ve seen more conventional appraisals some for the “soft” than simply You will find Va appraisals. However, they won’t fool around with you to definitely due to the fact a reason to cancel the fresh new bargain, nevertheless happens day long.

Real, however, possibly cash people will plan to bail towards the deal while they find something most useful

So let us move on to assessment holes. Really don’t for instance the practice, but see the must promote them to help you separate the give on the rest youre fighting which have. Seller’s love appraisal guarantees. and if you used to be offering, I could to ensure you’d too. So let`s say the consumers about situation over, guaranteed extremely if not completely it. How could your rates this new offers now? Did the manner in which you sensed whenever we been change anyway up to this point?

However, I am not able to exercise for the every detail away from a routine purchase like this just like the a purchase contract are a great way of life, respiration file which might be altered rather than the get agreements is actually written identically bad credit loans Troy AL. I am only trying mention the potential falling perils or roadblocks Virtual assistant customers have a tendency to experience with all of our field. The goal of this article is to help educate providers thus they may think providing serious attention in order to Experienced people. At the conclusion of the afternoon, the bucks a finances consumer brings into the closing table are identical to the cash a Va customer will bring. Along with promoting the guarantee, the thing a merchant are going to be worried about gets on the closure dining table and that i is remember no most useful way of getting here than taking an effective Va loan. The brand new viewpoints shown listed here are entirely exploit and never regarding RE/Maximum Alliance.

You state, this is exactly why I might bring the cash render since the majority ones wouldn’t want an appraisal

——- Since an experienced Va/Military-amicable Denver Agent which have Lso are/Max, Anthony Rael is actually fortunate to help you suggest local Va Lenders which understand the Va mortgage loan techniques and can bust your tail so you’re able to support the finest Va mortgage it is possible to. Because the Va pledges an element of the mortgage, this permits the mortgage financial to offer a lot more beneficial words (helping you save thousands of dollars!). Anthony Rael, the Va Military-friendly Agent with Re also/Maximum Alliance – 303-520-3179

I do want to directly thank All of our Solution Participants, Experts and you will qualified thriving partners for your sacrifice to the nation! I am always grateful on opportunity to let army household get & offer homes in the Denver Urban town. We manage resigned military people and suppliers & assist army family who are moving in or transitioning off effective-provider to various civil a job that have shelter builders instance Lockheed ics, Northrop Grumman, Boeing & Raytheon. We consider it an award and you will an advantage to provide professional, elite group a house properties in order to army parents and i expect in order to purchase or promote a home. When you yourself have questions in accordance with pre-qualifying to own Va Mortgage and looking a great household for the the fresh Denver city urban area, label Anthony Rael on (303) 520-3179