Triple-Entry Accounting And Blockchain: A Common Misconception

She sends thisto the server, Ivan, and he presumably agrees anddoes the transfer in his internal set of books.He then issues a receipt and signs it with hissigning key.As an important part of the protocol,Ivan then reliably delivers thesigned receipt to both Alice and Bob,and they can update their internal booksaccordingly. For the most part, these concepts simply reduceto “how do we implement double entry bookkeeping” ? As this question is well answered in the literature,we do no more than mention it here.

- The procedure of recording transactions in a triple/three-column cash book is similar to that of a double-column cash book.

- This paper brings together financial cryptographyinnovations such as the Signed Receipt with thestandard accountancy techniques of double entrybookkeeping.

- Each “block” in the blockchain contains a record of all the transactions that have taken place on the Bitcoin network since the block was created.

- Building on blockchain architecture, triple-entry accounting with smart contracts may resolve the fundamental trust and transparency issues that plague current accounting systems.

What is the triple-entry accounting

Accountants frequently review the trial balance to verify that they posted journal entries correctly, as well as to correct any errors. The concept of double entry accounting is the basis for recording business transaction and journal entries. Make sure you have a good understanding of this concept before moving on past the accounting basics section. Double-entry bookkeeping is an accounting system in which all financial transactions are recorded in two types of accounts, debits and credits. When you post a transaction, the number of debits and credits used can be different, but the total dollar amount of debits must equal credits. Triple-entry accounting is an innovative accounting system that expands traditional double-entry accounting by adding a third entry to each transaction, which is recorded in a secure, shared ledger.

A Very Brief History of Accounting

The total of the discount column on the credit side represents the total cash discount received from suppliers during the period and is posted to the discount received account maintained in the ledger. The innovations present in internal moneygo beyond the present paper, but sufficeto say that they answer the obvious questionof why this design of triple entry accountingsprung from the world of digital cash, andhas relevence back to the corporate world. The precise layout of the entries in softwareand data terms is not settled,and may ultimately become one ofthose ephemeral implementation issues.The signed receipts may form a naturalasset-side contra account, or theymay be a separate non-book list underlyingthe bookkeeping system and its two sides. Because information is collected directly from the double-entry bookkeeping transactions, accounting information in companies that use double-entry bookkeeping is simple to prepare. Businesses must produce accurate financial statements in a timely and efficient manner. Blockchain technology provides us with many benefits, and triple entry bookkeeping is one of those which can be used across many useful ways as it is fundamental to revolutionizing the way we manage finances.

Data Availability Statement

Keep in mind that every account, whether an asset, liability or equity, will have both debit and credit entries. In order to achieve the balance mentioned previously, accountants use the concept of debits and credits to record transactions for each account on the company’s balance sheet. And, with a single-entry system alone, large firms cannot accurately track their assets, liabilities, equities, revenues, and expenses. When you get started with accounting software, you can connect your various business accounts, and transactions will import automatically.

In order to explain, it’s best to provide a quick background on double-entry accounting, followed by blockchain and triple-entry accounting. There are many blockchains, but the most popular ones are Bitcoin, Ethereum, and Litecoin. For example, Bitcoin is mainly used for digital payments, Ethereum is used for smart contracts and decentralized applications, and Litecoin is similar to Bitcoin but has faster transaction speeds. Discount allowed is an expense, and discount received is an income of the business. And, we will record withdrawals by debiting the withdrawal account – Mr. Gray, Drawings.

Advance accounting methods for companies

Firstly, inthe Ricardo instantiation of triple entryaccounting, thereceipts themselves may be lost or removed,and for this reason we stress as a principle thatthe entry is the transaction.This results in threeactive agents who are charged with securingthe signed entry as their most importantrecord of transaction. Typically each party is responsible for maintaining their own financial records however this has often led to fraud or other errors. The use of triple-entry accounting reduces this risk by creating non-biased records. Many blockchains are publicly viewable or easily exposed to external viewing making them transparent with blockchain networks. The entry is the transaction because the assets are on the blockchain, in other words, the ledger is not an account of what happened it is literally what happened and as the ledger is immutable this makes it highly trustworthy for auditing.

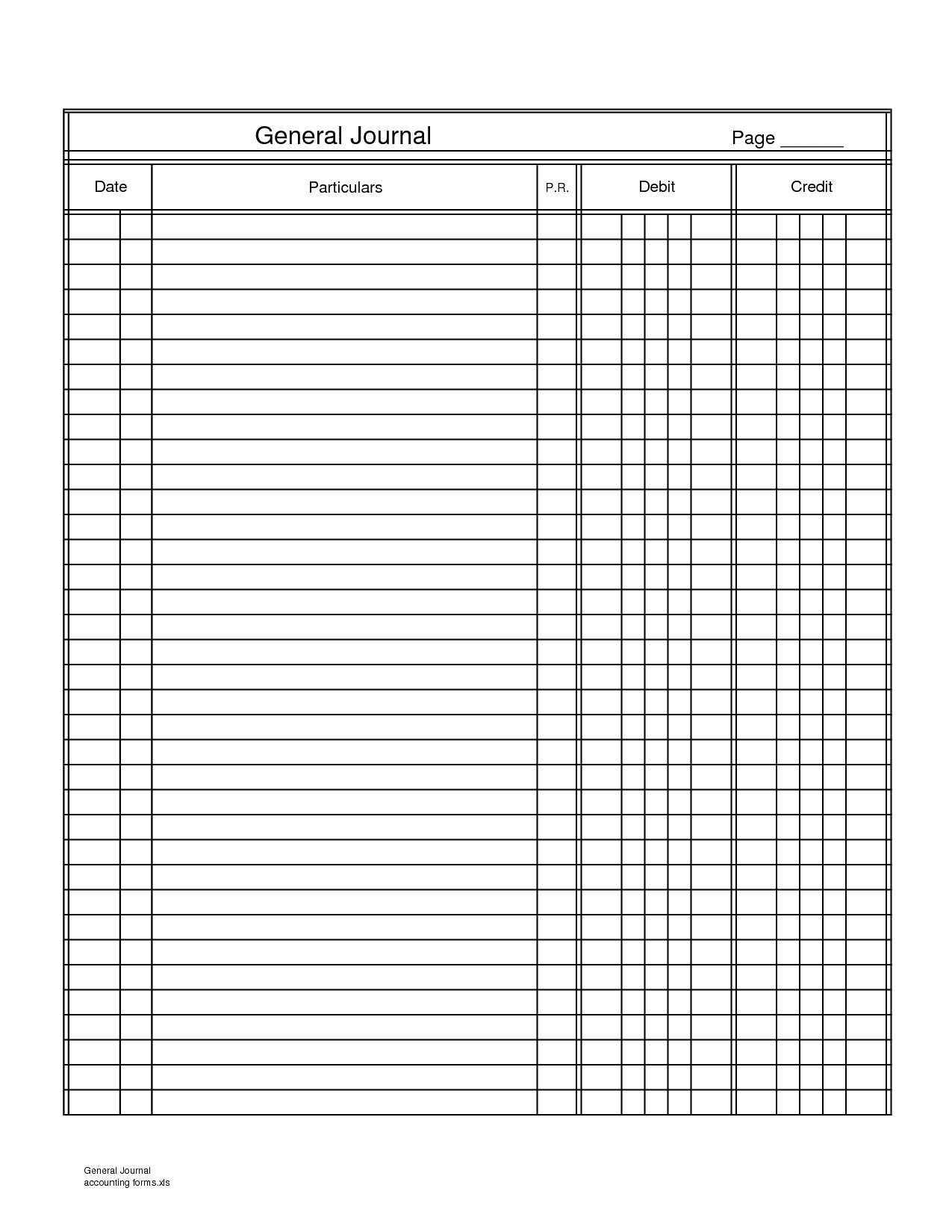

Accountants will use the general journal as part of their record-keeping system. The general journal is an initial record where accountants log basic information about a transaction such as when and triple journal entry where it occurred along with the total amount. Triple-entry accounting, on the other hand, is an accounting method for which a third component is added to the debit and credit accounting system.

Mitra believes that blockchain technology will play a critical role in maintaining audit quality. Triple-entry accounting with blockchain offers a new and potentially much more efficient way to achieve trust and transparency. If you are an accountant or auditor, staying ahead of the curve and getting certified in blockchain is essential. With AICPA certification, you will be positioned to take advantage of this exciting new technology and help your clients achieve trust and transparency in their financial dealings. By the terms “on account”, it means that the amount has not yet been paid; and so, it is recorded as a liability of the company. When Alice wishes to transfer value to Bob in someunit or contract managed by Ivan, she writes out thepayment instruction and signs it digitally,much like a cheque is dealt with in thephysical world.