Ways to get a knowledgeable HELOC costs during the Maine

Your credit score has the biggest influence on their HELOC speed. Consumers which have all the way down ratings can get large costs, and the ones with a high scores can get straight down pricing you to costs smaller. You could potentially do something to improve the score before you apply, such as for instance paying the loans, and come up with all of the costs timely, and you will checking your credit report getting mistakes to help you conflict any discrepancies.

No matter what their get, researching loan providers is among the most efficient way to find the lower rate for a HELOC from inside the Maine. Prequalify which have multiple loan providers to get into shot prices and acquire new lowest price to the financing. Most loan providers enables you to prequalify instead of damaging your credit rating. It’s an easy process that only requires a short while.

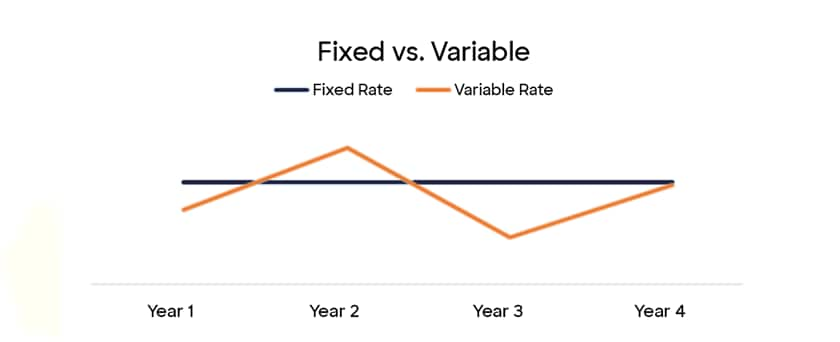

You need to think about the total cost of the financing, plus charges, closing costs, and you may changeable cost that can alter.

What are the Maine-certain conditions or regulations?

Maine keeps individual credit legislation to guard users, however the regulations don’t particularly apply to HELOCs. To qualify for a good HELOC for the Maine, you would like evidence of home insurance, guarantee of your property, proof of income, a minimal obligations-to-money proportion, and a powerful credit score. The financial normally respond to particular questions relating to their residence’s qualifications when the you have one.

Exactly what credit rating how would you like getting a great Maine HELOC?

So you’re able to qualify for a HELOC in the Maine, loan providers might look to possess a credit history of at least 620. However, a top credit score (over 700) helps you safe much more beneficial interest levels and you may words. Boosting installment loans for postal employees your credit score before applying can be lessen the price of the loan. Tips to improve your credit rating is paying down obligations, and work out all money punctually, and repairing any mistakes on your own credit report.

What are the regular charge to possess a great Maine HELOC?

Charge to have an effective HELOC may include app charges, appraisal charge, annual charge, and you may closing costs. Application and appraisal charge you’ll vary from $100 so you can $500, and you may yearly costs would be to $fifty so you’re able to $75. Closing costs generally speaking are normally taken for dos% to help you 5% of your full amount borrowed. Particular loan providers also can fees fees to possess maintaining the newest HELOC, such as for instance laziness costs unless you utilize the line from borrowing. Believe keeping an effective spreadsheet making use of some other charge it is therefore more straightforward to examine hence bank would be most suitable to you personally.

Are there any special apps or bonuses for Maine HELOCs?

Maine also provides numerous software that may promote bonuses otherwise recommendations for people looking to supply house equity. Brand new Maine Condition Property Power (MaineHousing) offers various house repair and you will improvement finance that may complement a good HELOC.

Local borrowing unions and you may people banking institutions can offer unique costs otherwise conditions having HELOCs to support regional home owners. It’s sensible to test which have regional loan providers your condition-certain applications or incentives that might be readily available

What the results are basically move to a new condition which have a beneficial HELOC within the Maine?

For folks who relocate to a unique county even though you possess good HELOC at your residence within the Maine, the newest terms of the loan typically will always be a comparable. You are going to remain guilty of to make payments based on the initial agreement.

Yet not, relocating might complicate particular aspects, for example being able to access mortgage qualities or handling your account. It is vital to keep in touch with the lender about your relocate to eliminate disruptions on the percentage processes. If you are planning to offer the house or property, you’ll pay-off the newest HELOC as part of the marketing exchange.

How exactly we find the best Maine HELOCs

Because the 2018, LendEDU has examined family guarantee enterprises to greatly help members find the most useful home equity funds and you may HELOCs. All of our most recent investigation assessed 850 investigation items out of 34 loan providers and you will creditors, with 25 analysis issues compiled off for every single. This post is gathered regarding organization websites, on line programs, public disclosures, customer reviews, and you will direct correspondence that have company representatives.